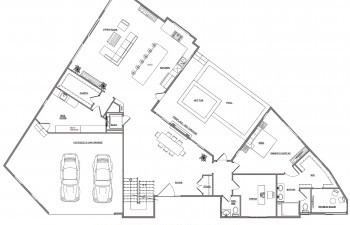

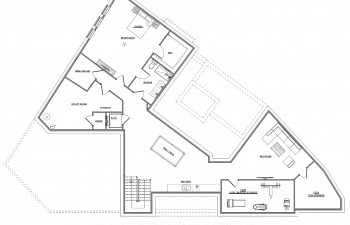

| 1847 Valley Wood Drive, Mclean, VA | Starting at |

| Living Space: 7,888 sqft Lot Size: 1 acres | $2,189,800 |

| Bedrooms 6 Bathrooms 5.5 Estimated Completion: May 2021 | |

Click any of the icons above that tickle your fancy.

Many banks give you two options for the loan(s) you choose:

One Time Close Benefits

Two Time Close Benefits

Ziberty Recommendation

Ziberty recommends a one-time close option in most cases. Typically the one-time rates are a little higher than the permanent financing rates. However, you cannot get the permanent financing rates prior to the home being complete. What really matters are the permanent rates compared to your one-time close rate when the home is finished. If the permanent rates are better, you can always refinance when the home is finished. Even if you chose a two-time close, you are essentially refinancing anyway with the second closing at the time the home is finished. Basically we think the one-time close has all the benefits, i.e. lock in a rate and there is no penalty to refinance to a lower rate (if available) when the home is finished, with limited negatives.

What's Very Similar?

What is Different?

Most constructoin loans are interst only during construction. Are the banks just trying to get more money out of you? Not really, the banks found that customers wanted ways to reduce their debt payments during construction. That is because most people are paying an additional mortgage or rent for their existing home while the new home is being constructed. Two home payments is a lot to cover for 6-12 months. The interest only payment will be significantly lower than a principal and interest payment. For example, at the point of construction where you have borrwed $800k between the land and construction, your interest only payment will be $1,110 less than a principal and interest payment. That can make a big diffferent while you are making two house payments.

| Bank |

|---|

|

| Highlights |

|---|

- Very helpful with the construction loan process |

|

Pre-Approval

Explanation coming soon. Contact |

| Bank |

|---|

|

| Highlights |

|---|

- Highly flexible construction loan options |

|

Pre-Approval

Explanation coming soon. Contact |

Copyright © 2026 Ziberty LLC. All rights reserved. | Legal

Please enter your email address. You will receive a link to create a new password via email.

Your password reset request has been received. Please check your email for further instructions on how to reset your password.

Your direct link was sent to the email address you provided.

Are you sure remove this property from your profile?