Land Value i

- Land Value is the value of the land that you intend to build the home on.

- It can be land you already own or land you will purchase.

- We use this value to calculate your mortgage payment. We assume that the full value of the land will be included as part of the loan.

- For example, if your land is valued at $500k and the new Ziberty home costs $500k, then your total value would be $1 million (assuming the home is valued at the cost). We assume you are putting 20% of the value down for the payments we show, so you would borrow $800k and put down $200k in this example. If you only owed $300k towards the land, then you would not have to put any additional down payment out of pocket.

Site Cost i

Home Attributes i

This is the guaranteed price for the home based on the attributes you have selected during the "Home Attributes Selection" step. The home attrbutes price includes a finished home with bronze level finishes.

Home Packages i

The Home Packges price is the total price of all of the packages you have selected. Bronze pricing is included in the Home Attributes price. Therefore, the Home Packages price is the total cost of the packages that you have selected in the Silver, Gold, or Platinum package level.

Land + Site + Home Cost i

The Land + Site + Home Cost is adding the land cost (based on the land value you entered), the site costs (based on the average value of your area or the value you entered), and the total Home Cost. The total Home Cost includes the Home Attributes and the Home Package costs.

Mortgage Payment i

This is your estimated monthly mortgage payment for principal and interest. We assume your loan amount will be 80% of the Total Land, Site, and Home Costs. We use the average national 30 year fixed rate in the calculation.

Down Payment i

This is the estimated down payment for your mortgage. We assume a 20% downpayment. We assume the land value, site cost, and home costs are included in the mortgage.

Home Attributes Selection

Fine-tune the parameters of your new home by choosing your desired attributes below.

-Bedrooms can be placed on any floor of the house

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Bathrooms can be placed on any floor of the house

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-The sqft selected is for the floors of the home above the basement. All rooms selected in the house must fit into the sqft selected.

-The basement (if selected) sqft will match the sqft of the first floor (not including the garage). For a two story home, the basement sqft is approxomately two fifths of the sqft selected here. For a single story home, the basement sqft is approximately equal to the sqft selected here.

-If a loft is selected, it is the only room that adds finished sqft above the sqft selected here.

not including basement Total liveable finished sqft approx. 0.- 1500 - 1699

- 1700 - 1899

- 1900 - 2099

- 2100 - 2299

- 2300 - 2499

- 2500 - 2699

- 2700 - 2899

- 2900 - 3099

- 3100 - 3299

- 3300 - 3499

- 3500 - 3699

- 3700 - 3899

- 3900 - 4099

- 4100 - 4299

- 4300 - 4499

- 4500 - 4699

- 4700 - 4899

- 4900 - 5099

- 5100 - 5599

- 5600 - 6099

- 6100 - 6599

- 6600 - 7099

- 7100 - 7599

- 7600 - 8099

- 8100 - 8599

- 8600 - 9099

-The number of stories selected is the number of floors above the basement (if selected)

- 1 is a single storey home (above basement)

- 2 is a two storey home (above basement)

not including basement–Assumes 250 sqft per garage space

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

- Conventional Wood

- SIP Walls

- Insulated Concrete Forms - ICF

- Timber Frame

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of basement is an average size corresponding to the size of the home (based on sqft selected)

Adds approx 0 sqft to total .- No

- Finished

- Unfinished

Rooms must fit into sqft selection above.

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Size of room is an average size corresponding to the size of the home (based on sqft selected)

- Selecting a loft adds living space at the attic level

Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

Adds 0 sqft to total.-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-Price includes bronze packaging

-Bronze, Silver, Gold, and Platinum selections are available in the “packages selection” section

-The floor height is the height from floor to ceiling

- 8

- 9

- 10

- 11

- 12

- 8

- 9

- 10

- 11

- 12

- 8

- 9

- 10

- 11

- 12

Represents the footprint of the 2nd floor that matches the 1st floor. Maximum price efficiency is attained when the second floor footprint is very similar to the 1st floor.

- 97 - 100%

- 90 - 96%

- 83 - 89%

- 75 - 82%

- 65 - 74%

- 50 - 64%

- 40 - 49%

- 30 - 39%

- 20 - 29%

- 10 - 19%

When rooms are larger than 20x20, steel beams maybe required to span the weight of the floor. This is mostly true in basements and main levels.

- 0

- 1

- 2

- 3

- 4

- None

- Few

- Moderate

- Many

- Very Many

- Very Simple

- Simple

- Normal

- Complex

- Very Complex

- Front

- Side

- Courtyard

- Basement

Ceiling angles upward on one or both sides to create volume in the room.

The cost assumes that 500 sqft of the top floor is vaulted.

![]()

- No

- Yes

Yep, these prices are guaranteed, you are providing enough information that we don’t even need a house design!

| Default Price | 0 |

|---|---|

| Bedrooms | 0 |

| Baths | 0 |

| Square Feet | 0 |

| Stories | 0 |

| Garage | 0 |

| Framing Type | 0 |

| Basement | 0 |

| Other Rooms & Options | 0 |

| Floor Height | 0 |

| Other Attributes | 0 |

| House Plans & Eng. | 0 |

| Interior Designer | 0 |

| Home Attributes as Configured | 0 |

Home Packages Selection

View and choose your desired package level for each home feature.

Packages will be available once you set the home attribute on first step

| Home Attributes as Configured | 0 |

|---|---|

| Package Pricing | |

| Kitchen | 0 |

| Bedrooms | 0 |

| Bathrooms | 0 |

| Other Rooms | 0 |

| Interior | 0 |

| Exterior | 0 |

| Behind the Scenes | 0 |

| Others | 0 |

| Total Package Price | 0 |

| Total Home Price | 0 |

Yep, these prices are guaranteed, you are providing enough information that we don’t even need a house design!

-

Bronze

-

Silver

-

Gold

-

Platinum

We make it easy to cut to the chase on the financing of a Ziberty home.

Click any of the icons above that tickle your fancy.

Fill out the form below to get Ziberty's educated guess on your financing options

Helpful tidbits for financing a new home.

One Time Close or Two-Time Close?

Many banks give you two options for the loan(s) you choose:

One Time Close Benefits

- Rate Lock

- Usually the construction and permanent rates are locked in at closing before the home is built.

- In a rising rate environment, it is nice to know your rate won't go up (unless you chose a variable rate mortgage like a 5/1 ARM)

- Usually the construction and permanent rates are locked in at closing before the home is built.

- Loan Fees One Time

- The overall loan fees are typically lower for a one time close

- Less Paperwork and Hassle

Two Time Close Benefits

- Construction Rate Can Be Lower

- Sometimes the rate during construction can be lower with a construction only loan

- In a steady or declining rate environment, the rate you get on the permanent financing is typically lower than the one-time close options

Ziberty Recommendation

Ziberty recommends a one-time close option in most cases. Typically the one-time rates are a little higher than the permanent financing rates. However, you cannot get the permanent financing rates prior to the home being complete. What really matters are the permanent rates compared to your one-time close rate when the home is finished. If the permanent rates are better, you can always refinance when the home is finished. Even if you chose a two-time close, you are essentially refinancing anyway with the second closing at the time the home is finished. Basically we think the one-time close has all the benefits, i.e. lock in a rate and there is no penalty to refinance to a lower rate (if available) when the home is finished, with limited negatives.

New Home Construction Financing vs. Purchasing an Existing Home

What's Very Similar?

- Financial and Credit Requirements

- Approval Process

- Permanent financing options, rates, and fees

What is Different?

- Interest charges

- Typically the bank releases funds to the builder in stages as the home is being built, and you only pay interest on what you have borrowed to date

- Loan during construction is typically interest only

- Most customer's loans are above the FHA limits for construction financing

- Two primary options for construction loan (vs. always a one time close for loans on existing homes)

- One time close

- This means that you go through ONE loan approval and closing process to approval both the construction and permanent loan. In some cases the loan is the same loan.

- Two time close

- This means you close on the construction loan before construction, and then have an additional closing prior to starting the mortgage on the finished house

- One time close

- Many banks, especially many of the larger banks, don't do construction financing

- Occasional differences

- Some banks won't have down payment options for construction financing that are less than 20%

- The bank may require more cash reserves in your accounts to allow for budget overruns during construction

- Some banks don't have all the products available for construction as they do for loans on existing homes. For example, so banks don't have VA construction loans

Why Construction Loans are Typically Interest Only?

Most constructoin loans are interst only during construction. Are the banks just trying to get more money out of you? Not really, the banks found that customers wanted ways to reduce their debt payments during construction. That is because most people are paying an additional mortgage or rent for their existing home while the new home is being constructed. Two home payments is a lot to cover for 6-12 months. The interest only payment will be significantly lower than a principal and interest payment. For example, at the point of construction where you have borrwed $800k between the land and construction, your interest only payment will be $1,110 less than a principal and interest payment. That can make a big diffferent while you are making two house payments.

Calculate Mortgage Payment

Our recommended banks and pre-approvals

Explanation coming soon.

| Bank |

|---|

|

| Highlights |

|---|

- Very helpful with the construction loan process |

|

Pre-Approval

Explanation coming soon. Contact |

| Bank |

|---|

|

| Highlights |

|---|

- Highly flexible construction loan options |

|

Pre-Approval

Explanation coming soon. Contact |

Schedule time with us to review this property!

info@ziberty.com - (703) 488 8423

Please provide the following information to get started.

Please update the site cost.

This default site cost is at the low end of your market. You can change this number if you choose to.

Site costs typically include:

- Civil engineering plans and surveys

- Permit fees (grading and building)

- Tear Down of existing home (if needed)

- Excavation and dirt removal

- Erosion control and tree protection fencing

- Tree removal

- Utility installation and municipal tap fees

- Stormwater systems (rain gardens for example)

- Site Grading

- Landscaping area above what is included in the landscaping package

- Driveway area above what is included in the driveway package

Costs in the DC region typically range from $100k - 200k. Ziberty's home prices are guaranteed, but site costs cannot be guaranteed until the grading permit is issued by the proper municaplity. We can estimate your site costs by reviewing the lot. We can fine tune the site cost estimate after the engineers create the grading/site plan. When the grading permit is issued, we can then provide a guaranteed price becuase the scope of the site work has been finalized.

Some site related costs are included in Ziberty's home cost (all based on set sizes/area). They are:

- Landscaping

- Driveway

- Front walkway

- Deck/patio if selected

- Exterior lighting

These are costs that are not typically included in the home price, which is something to consider if you are comparing Ziberty's price to a competitor.

The framing type is primarily how the above grade exterior walls are constructed. Regardless of the framing type selected, the foundation walls of all Ziberty homes are poured concrete.

Conventional Wood Framing

Conventional wood framing is how the vast majority of homes built in America (outside hurricane zones) are constructed. The exterior wall structured is primarily 2x4 or 2x6 wood studs with OSB sheeathing on the outside. The sheating is wrapped in a moisture resistance barrier or comes with the moisture reistance baked into the OSB.

SIP Walls

SIP stands for structural insulated panel. The panels consist of an insulating foam core sandwiched between two structural facings, typically oriented strand board (OSB). The primary benefit of SIP Wall is improved energy efficiency of the home as compared to a conventional wood framed house with regular batt insulation. To learn more about SIPs, we recommend SIPs.org (click here).

Insulated Concrete Forms - ICF

Insulated concrete form walls (ICF) have hard foam on the exterior and interior side of the wall with pourced concrete and rebar in in between. The walls are built using hollow hard foam blocks. The blocks are stacked on each each other to form the walls, rebar is placed in cavities of the blocks, and concrete is poured into the concrete. ICF walls are very energy efficient, strong, quiter, highly wind resistant, and fire resistant. To learn more about ICF walls, we recommend ICF Magazine (click here). For a quick video, check out this ICF Video (excuse the pitch by this particular brand of ICF)

Timber Framing

Timbrer Framing is the use of heavy timbers (posts and beams) for the structural framing of the home. The timbers can be held together with heavy duty metal brackets or with wood joinery, such as mortise and tenon. The sections in between the posts can be framed with regular conventional framing or SIP Walls. In the 21st century, the primary reason people choose timber framing is for the beauty of the wood exposed on the interior. The vasty majority of timber framed homes have the timbers exposed on the interior. To learn more about timber framing, we recommend TFguild.org (click here)

Very Few

-No curves or change in angles

![]()

Few

-Some 45' angles

![]()

Moderate

-Some curves

![]()

Many

-Increased amount of curvature

![]()

Very Many

-Extensive curvature

![]()

Very Simple

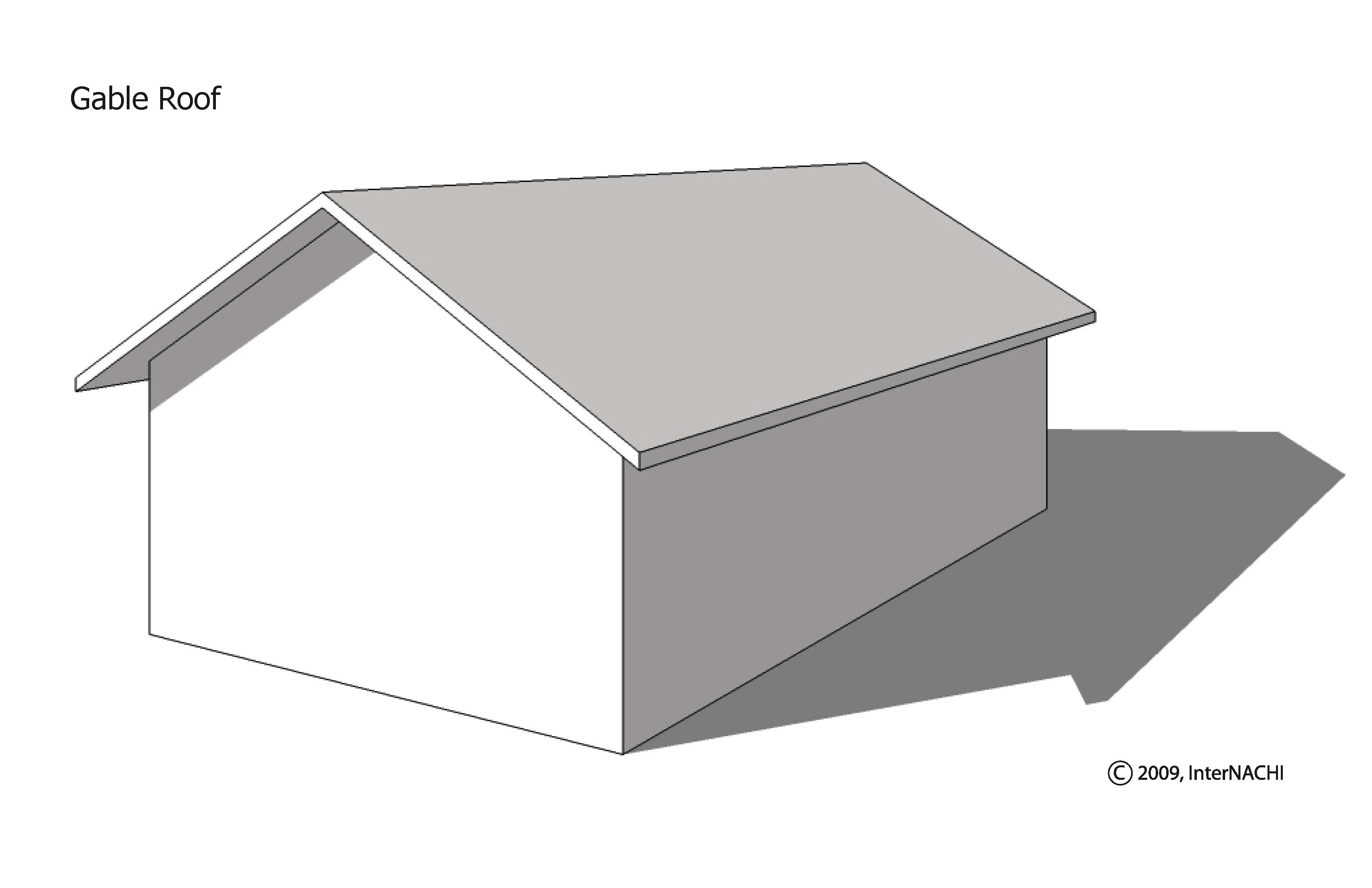

Gable Roof

Simple

Double Gable

![]()

Normal

Hip Roof or equivalent

![]()

Complex

Multiple Hip and Gable

![]()

Very Complex

Flat Roof (structurally complex to support snow and prevent leaks)

![]()

Front Garage Entry

Side Garage Entry

![]()

Courtyard Garage Entry

![]()

Basement Garage Entry

![]()

House Plans

If you select "House Plans", we'll use your selected floor plan characteristics as a starting place for designing your home from scratch while working with with one of our preferred architects. We can also gladly work with your own architect of choice or start from any floorplan you already have in mind (do not select House Plans in this case)

Engineering

After the home design is completed, the engineers will create the structural plans. If you select House Plans, then Engineering is automatically selected because we will use one of our preferred engineers if we are working with one of our preferred engineers (the architects and engineers are usually from the same firm). If you have your own set of plans or architect, but the plans do not include structural drawings, then you can select Engineering and use one of our preferred engineers to create the structrual plans. If you already have a structural set of plans, then you do need to select Engineering.

Interior Designer

Access to a kitchen and bath designer is included at no charge with all of our kitchens and master baths above the bronze level. Selecting Interior Designer here provides access to an interior designer for house. The level of involvement of the designer is determined by the chosen level of the interior designer package (Home Packages step).

Copyright © 2024 Ziberty LLC. All rights reserved. | Legal